By David R. Guttery, RFC, RFS, CAM

President, Keystone Financial Group-Trussville Al

Over the last few months, I’ve written about how inflation, and Federal Reserve policy has impacted both the markets and the economy, and today I have some reasons for optimism to share with our viewers. Call them, “green shoots” if you will.

I see signs that are encouraging to me, that suggest economic conditions may be stabilizing, and that market segments are demonstrating encouraging patterns of behavior. In about six weeks, some of us will begin planting our gardens. For me, that involves a lot of tomatoes. At some point early in the season, you begin to notice the yellow blooms giving way to tiny green balls. It’s exciting to see that fruit is beginning to emerge, but it’s still not time yet to make salsa.

I see signs that are encouraging to me, that suggest economic conditions may be stabilizing, and that market segments are demonstrating encouraging patterns of behavior. In about six weeks, some of us will begin planting our gardens. For me, that involves a lot of tomatoes. At some point early in the season, you begin to notice the yellow blooms giving way to tiny green balls. It’s exciting to see that fruit is beginning to emerge, but it’s still not time yet to make salsa.

I would suggest to anyone reading this article, that right now, I believe we have several of these tiny green balls that hopefully will turn into ripe tomatoes over the course of the year. It’s encouraging to see, but the quality of the fruit depends on weather conditions ahead that we aren’t able to predict. Economically and financially speaking, I believe that future policy decisions of the Federal Reserve, and its messaging, are critical weather elements that must be favorable for these promising green shoots to produce a fruitful harvest.

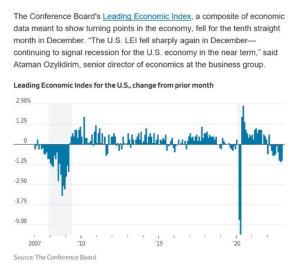

First, let’s take a look at the leading economic indicators. There are 10 of them, and collectively we refer to this as the index of leading economic indicators. It is designed to give you an idea of where we are heading. Many economic indicators, such as gross domestic product for example, are backward looking in nature and they tell you where we have been. Within several of my last videos, I suggested that markets were shocked last year when the Federal Reserve unveiled what turned out to be the most aggressive schedule of tightening in 35 years.

Over the course of last year, I believe that market participants assumed that the potential recession would be very deep, and very long. Reminiscent of the great recession in 2008. Throughout last year however I suggested that I believed any future recession would be shallow in frequency, and long in duration. I did not believe that another great recession style event would evolve. Indeed, looking at the leading economic indicators today, that seems to be developing. I believe that markets anticipated something much worse than what we are actually experiencing.

If this continues, and indeed the economy is only slightly recessed, I believe that market participants will be compelled to reprice risk in a positive way, if previously made assumptions prove to be incorrect as they pertain to the economy.

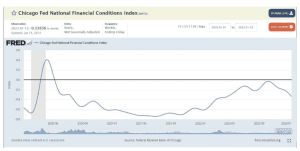

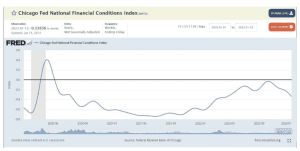

The financial conditions index, from the Chicago Federal Reserve, indicates that conditions continue to improve. If that line is going down, it’s a good thing.

In November of last year, the Federal Reserve told us that future policy decisions will be driven by observations of current data, and likely to reflect a less hawkish posture. They never indicated that tightening would cease, but they suggested it could possibly slow down. Since that time, we have had multiple meetings of the Federal Reserve Board itself, as well as the Federal Open Market Committee, and they have reiterated this message since that time.

Inflation is moving in the right direction, but I believe markets have assumed that the Federal Reserve would take a scripted approach to monetary policy without regard for evidence of economic declination. This does not seem to be the case however, and over time, it is my hope that market participants will be inclined to find comfort in the thought that there will be no significant departure from this less hawkish stance.

Shelter is a major component of the consumer price index, and is something that has stubbornly driven elevated levels over previous months. Another green shoot appears to be that “rent equivalents”, which is a proxy for the shelter component in the CPI index, is also moving down in a noticeable way. If this continues, then it should translate into future, increasingly favorable inflation readings.

As far as tangible goods are concerned, it would appear that inflationary forces in this area of the economy are also trending in the right direction. As I discussed within our last article, according to the Institute for Supply Management, commodities that were reported to be short in supply, and up in price, were both declining significantly.

Unfortunately, the majority of inflationary pressures remain at the food, fuel, energy, and healthcare level. These are beyond the ability of the Federal Reserve to control with a simple rate hike. There is more work to be done with regard to controlling inflation, but we definitely see positive signs that it is trending in the right direction, and because of that, I believe that the Fed will remain committed to the posture they described in November of last year.

I believe that volatility in the equity and fixed income markets is beginning to subside, however I would caution that this trend will develop over time. Again, markets were shocked last year when the Fed unveiled the most aggressive schedule of tightening that we had seen over the previous 35 years, while simultaneously describing inflation as being short-term, and transient. Rather than discounting the coming years into current valuations, I believe that markets became very shortsighted, and not looking beyond the next 30 days until the subsequent meeting of the Federal Reserve Board.

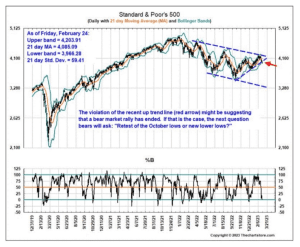

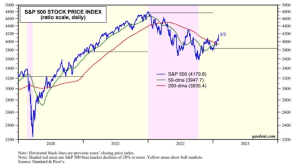

I do believe however this is beginning to change, and we can quantify that by taking a stochastic look at sectors of the market. Again, to me this is a green shoot, but it’s encouraging. Any stocastician will tell you that a series of lower lows, and lower highs, is not a good thing. As we have tested the same static Bollinger band for sixth time however, notice on the top part of this chart that it appears a new trend may be beginning, of higher lows and higher highs. It would also appear that the current trend is about to run into a longer term resistance band. The question is, does this momentum continue, and if it does, will it constitute a meaningful breakthrough of that resistance band?

That remains to be seen, but we can take a look at certain market segments and find what I believe to be encouraging signs that this may be the case.

Looking at the financial sector, it would appear that we are indeed staging a breakout through what has been a reasonably long level of resistance, as rising bond yields are seemingly favorable to diversified financials even while the Fed is draining lendable reserves.

Industrials are also showing encouraging signs of what at least seems to be a pattern reversal. Hopefully, this also results in a breakthrough of a longer resistance trend, but that remains to be seen.

Personally, I don’t think that the Federal Reserve will begin cutting rates anytime soon, and I certainly don’t believe that they will consider a subsequent round of quantitative easing. There is still much work in front of the Fed to unwind the balance sheet that remains historically bloated.

I too have heard opinions from within various business media sources that eventually the Federal Reserve will be inclined to potentially reverse course and began adding to its balance sheet again, and in my opinion, this is just not grounded in reason. The Federal Reserve has only begun to unwind its balance sheet. This unwinding has to be done, or will result in a greater problem than the one they are attempting to solve now.

I do think however this illustrates the gap that remains between market expectations, and reality as it pertains to the future policy of the Federal Reserve. Over time, as economic and financial conditions improve, and the Fed remains steady in pursuing its stated objectives, I believe that these expectations will become more congruent with reality.

Will there be signs or observable evidence that markets are indeed becoming comfortable with the thought that the Federal Reserve won’t shock the markets again as they did last year with an unexpected shift in policy? Yes, I believe so. At a high level, when good news is good news again, that will be a telling sign. Recently, we received a good, but hotter than expected reading from the Labor Department. The good news is that we created many more jobs than the market was expecting to see. The bad news is, that apparently markets anticipated that the Federal Reserve would respond with a significant shift in policy, in an effort to pour cold water on that development.

Again, I don’t think this is rational thought. The Federal Reserve is trying to avoid stagflation. In order to do that, the economy has to be moving forward. In my opinion, as long as the financial conditions index continues to move in the right direction, and, as we previously observed, metrics of inflation continue to improve, then I don’t believe there is reason to assume that the Federal Reserve will significantly change its policy stance over one, or a few hotter than expected economic reports.

At a very high level, my anticipation is that volatility will remain higher than average for the first half of this year, but if these trends continue to unfold, I believe that in the second half of the year we could see volatility, as measured by the VIX index, returning to more normal levels, as markets are increasingly encouraged to reprice risk in a positive way, because assumptions made about the economy last year might have been overly nefarious.

Again, green shoots. It’s encouraging to see that we have them, but we still need to remain vigilant, and actively manage portfolios for risk. Pardon the cliché, but this is indeed a marathon and not a sprint. This will not resolve tomorrow, or next month. This is a long-duration event, and we are a long way from the finish line. However, it does appear that we are moving in the right direction. To quote the late Winston Churchill, this is not the beginning of the end, but it may indeed be the end of the beginning.

(*) David R. Guttery, RFC, RFS, CAM, is a financial advisor, and has been in practice for 31 years, and is the President of Keystone Financial Group in Trussville. David offers products and services using the following business names: Keystone Financial Group – insurance and financial services | Ameritas Investment Company, LLC (AIC), Member FINRA / SIPC – securities and investments | Ameritas Advisory Services – investment advisory services. AIC and AAS are not affiliated with Keystone Financial Group. Information provided is gathered from sources believed to be reliable; however, we cannot guarantee their accuracy. This information should not be interpreted as a recommendation to buy or sell any security. Past performance is not an indicator of future results.